More than four million pounds lost - with the oldest and most-vulnerable most at risk – but this time it's not the banks' fault.

Worse, if you're left on the hook the there's almost nothing you can do to get your money back. So what is 'vishing' and how can you stay safe?

Vishing – the fraudsters' tricks exposed

“Vishing is where a criminal will pretend to be your bank or the police & make you believe your money is at risk,” the Financial Ombudsman explains.

Criminals generally will call you and try and persuade you you money is at immediate risk.

The only way you can protect it, they tell you, is to withdraw it or move it to a safe account fast.

Generally they want you to transfer the money online or over the phone, but there have been cases when people have made transfers in their bank branch or handed their card to a courier who arrives at the door.

Sound a bit too obvious to fall for? This is where the clever part of the fraud comes in.

Spoofing and no-hang ups

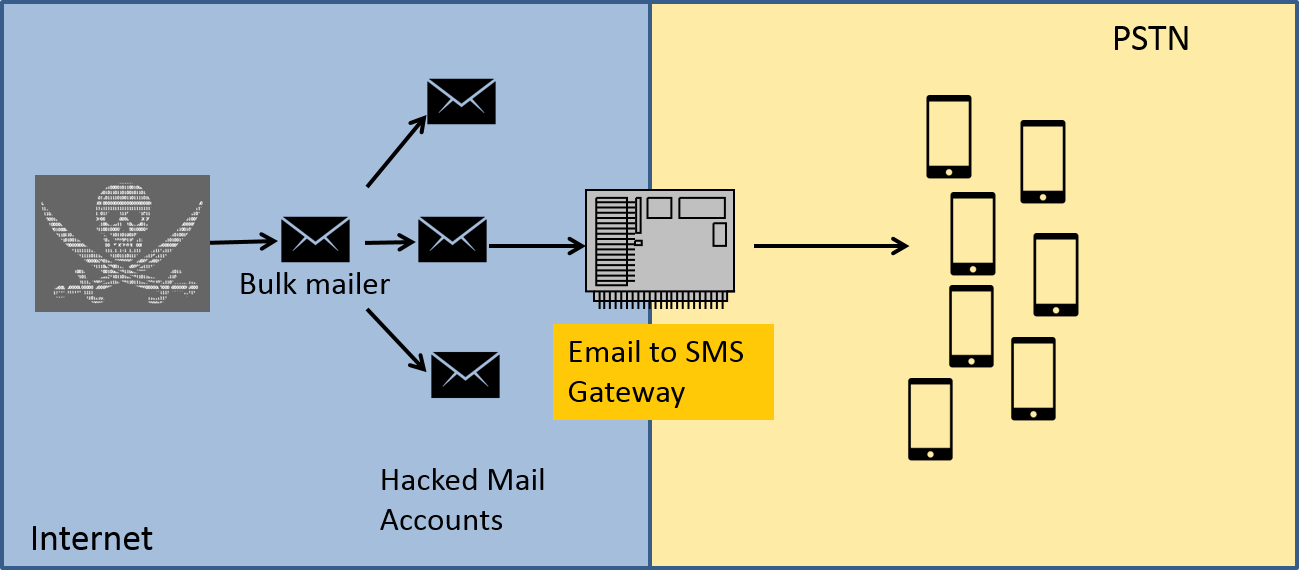

The first trick they use is something called “spoofing”. This technical trick allows a criminal to impersonate your bank, either with their number coming ups as the same as your bank's or potentially even texts coming into the same conversation string as real ones from your bank .

So from the outset the criminal looks like they are legitimate.

The second trick is called a “no hang up”. If they've called you and you the line isn't closed until they hang up, no matter if you do or not.

That means you can hang up, then dial your real bank number (or any number for that matter), but when you pick up the phone it's still the criminal on the other end of the line.

And it's this techincal trick that flummoxes the most careful people.

“I regard myself as someone who is careful about money and security. I always burn any disused private papers and cover my PIN at card machines. But on this occasion, I was totally taken in and conned,” explained one victim.

Once they've convinced their victim of the risk to their money, they get them to transfer it to a fake account, hand their card details (or card itself) over, or even withdraw money and pay it in to the criminal's account.

“These are extremely cruel and convincing deceptions and consumers are tricked into believing they are protecting their money, when in fact it is being stolen,” sad chief ombudsman Caroline Wayman.

“Scammers are relying on people’s vulnerability and vishing is particularly insidious in exploiting this. This is why we really want to share what we are seeing in the complaints we handle and encourage people to get talking about scams with their friends and relatives so they become more alert to the risks - stopping the fraudsters in their tracks.”

While, generally, if someone impersonates you and takes your money the bank IS liable – and will generally give you your money back as long as you can show you weren't negligent.

Of those who were caught out by vishing fraudsters, almost three people in four (73%) who had been caught out by this scam felt the bank was responsible and should provide a refund, and four in nine thought their bank could have done more to stop the criminals, the Ombudsman revealed.

But in this case, the banks are mostly off the hook.

“Banks have a duty to act on their customers’ instructions. So if a consumer transfers or withdraws money themselves during a scam, they’re unlikely to get it back,” the Ombudsman explained.

But don't lose all hope, because in some cases the Ombudsman looked into the bank was found to not have treated its customers fairly.

In some cases they found that the bank could well have done more, and forced them to pay the customer back in full. But this is rare.

The best advice is to be as careful as possible before transferring your cash .

What to watch for and tell your parents and relatives to look out for

“Fraudsters often target the vulnerable and that is why we are urging people seeing relatives over the summer to highlight the risks and prevent these scams happening in the first place,” the ombudsman said.

To help, here are their hints and tips to help people to protect themselves from financial fraud:

- Never give out personal or banking information when answering an incoming call, and don’t always rely on the Caller ID for identification.

- If you’re in any doubt about the identity of a caller claiming to be from your bank or the police, hang up and call the phone number on your account statements, back of your debit or credit card, in the phone book, or on the company's website. Use a different phone or wait at least five minutes before making the call to make sure you’re not speaking to the same fraudsters.

- An easy way to protect your financial details is by shredding bank statements, receipts and other documents containing any financial information, such as account numbers.

- Remember, if your bank suspects your account has been compromised by fraudsters they will usually ‘freeze the account’ which will prevent any transactions happening – there is no need for you to do anything.

The banks and police assure you they will NEVER:

Ask you to authorise the transfer of money to a new account or hand over cash

- Ask for your PIN or passwords in full on the phone or via email, including keying your PIN into the phone keypad

- Send someone to your home to collect cash, bank cards or anything else

- Ask you to send personal or banking information via email or text

- Send an email with a link to a page which asks you to enter your online banking log-in details

- Ask you to carry out a test transaction online

- Provide banking services through any mobile apps other than the bank’s official apps

- Call to advise you to buy diamonds, land or other commodities

No comments:

Post a Comment